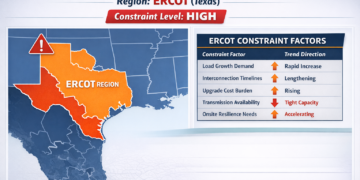

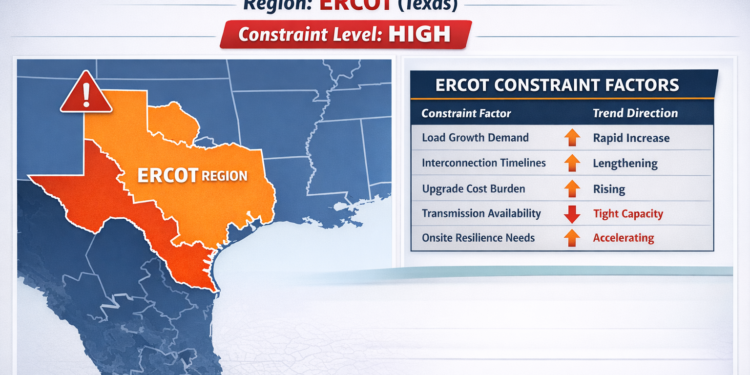

Texas continues to attract large-scale industrial investment at a pace few markets can match. Manufacturing capacity is expanding. Data center development remains aggressive. AI-driven load forecasts are climbing. Electrification trends are accelerating across multiple sectors.

However, alongside that growth, a quieter constraint is emerging.

In several parts of ERCOT, power delivery timelines are beginning to lag behind project timelines.

This is not a story about generation scarcity. Texas continues to add capacity. Instead, the issue centers on infrastructure speed. Load growth is increasing faster than transmission upgrades, substation expansions, and interconnection processes can move.

As a result, grid access can no longer be treated as automatic.

Why ERCOT Is Tightening

Three dynamics are converging.

First, large-load requests have increased in both frequency and scale. Projects that once required 20–40 megawatts now routinely request 100–300 megawatts or more. That level of demand places pressure not only on generation, but on the delivery network that supports it.

Second, transmission planning operates on multi-year cycles. Utilities must model system impacts, secure approvals, and construct upgrades deliberately. Meanwhile, developers and operators often move on quarterly capital timelines. The difference in pace creates friction.

Third, equipment and upgrade constraints remain real. Substation expansions require time and coordination. Transformer lead times continue to stretch. Interconnection studies are becoming more complex as more projects target the same nodes.

Individually, these factors are manageable. Combined, they create tightening conditions in select growth corridors.

A Market Signal Worth Watching

Recently, a large industrial project in Texas secured site control and advanced through permitting and financing milestones. During the interconnection study phase, required network upgrades extended the projected timeline for full power delivery by several years.

The project did not stop.

But its execution schedule changed materially.

Similar situations are appearing with greater frequency.

For developers and operators, this represents a shift in risk profile. Energy delivery has moved closer to the critical path.

Energy as a Schedule Variable

Historically, developers treated electricity as a utility input that would align with construction completion. Today, that assumption requires verification.

If commissioning occurs before upstream upgrades are complete, the impact becomes immediate. Revenue shifts. Capital deployment stretches. Project sequencing must adjust. In large-load scenarios, even modest grid delays can produce significant financial implications.

Therefore, energy strategy increasingly belongs in early-stage site evaluation and risk modeling discussions.

What This Means for ERCOT Expansion

Texas remains one of the strongest growth environments in North America. The investment case is intact. The economic fundamentals remain compelling.

Nevertheless, the grid is no longer plug-and-play in every corridor.

Organizations planning major load additions in ERCOT would benefit from early, structured analysis of:

• Realistic interconnection timelines

• Upgrade exposure and sequencing

• Infrastructure dependency risk

• Potential flexibility through phased or hybrid approaches

Understanding grid conditions early reduces execution uncertainty later.

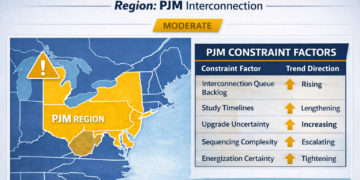

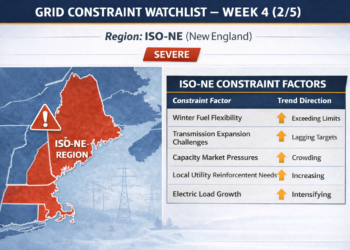

This Watchlist will continue with PJM next — where backlog, rather than velocity, drives the constraint narrative.

Author Note

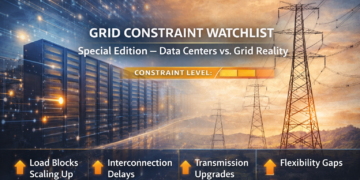

The Grid Constraint Watchlist tracks power delivery dynamics across major U.S. markets as industrial and data-driven load continues to expand.

If you are evaluating an ERCOT project or navigating interconnection timelines firsthand, you are welcome to reach out to compare perspectives: