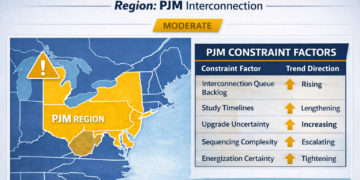

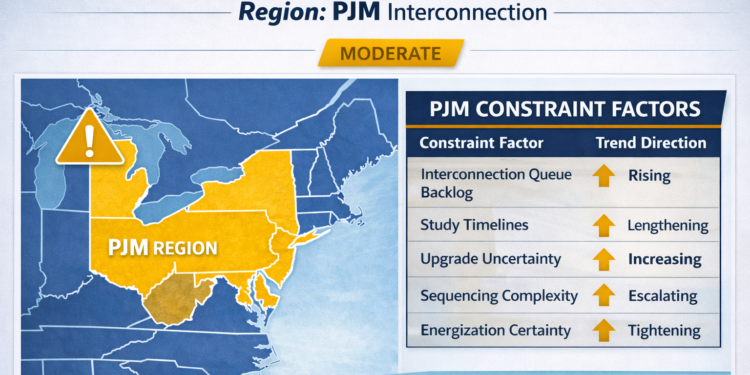

If ERCOT’s challenge is speed, PJM’s challenge is queue depth.

PJM covers some of the most economically dense regions in the United States — Northern Virginia data center corridors, Mid-Atlantic manufacturing hubs, major logistics infrastructure, and expanding electrified load.

Demand is not the surprise.

The surprise is how long it is taking projects to move through the interconnection process.

In PJM today, the constraint is not primarily generation capacity. It is the interconnection backlog and the time required to clear it.

The Backlog Effect

Over the past several years, PJM’s interconnection queue expanded dramatically. Renewable generation, storage projects, and large-load additions stacked up simultaneously. As the queue grew, so did study complexity.

PJM has since restructured its process to address the backlog. That reform is necessary. However, transition periods introduce delay.

Projects that once expected predictable study timelines are now facing extended review periods, clustered processing, and sequencing uncertainty.

The result is simple:

Power delivery timing is harder to forecast.

Where the Pressure Is Concentrated

The Northern Virginia data center market illustrates the issue clearly. Load growth in that region has accelerated to historic levels. As hyperscale expansion continues, transmission and substation infrastructure must keep pace.

At the same time, broader PJM territories are seeing electrification-driven load increases, advanced manufacturing investment, and grid modernization requirements.

Multiple forces are competing for system capacity.

Even where generation is available, the path to deliver it reliably and on schedule can require significant upgrades and long planning horizons.

A Market Signal Worth Watching

Recently, a large data-driven development in the PJM footprint entered the interconnection process expecting a standard review cycle. During the study phase, required network upgrades materially extended the projected energization date.

The issue was not project viability.

It was sequencing and system impact.

In other words, the project did not lack demand or capital — it encountered infrastructure timing.

That distinction matters.

Energy Certainty vs. Energy Availability

PJM is not short on ambition or investment. However, developers must now separate two concepts:

Energy availability and energy certainty.

Capacity may exist within the broader market. Yet delivering that capacity to a specific site, at a specific scale, on a specific timeline, requires navigating interconnection studies, upgrade requirements, and system constraints.

For large-load operators, uncertainty around energization dates complicates construction schedules and financial modeling.

Therefore, energy strategy must move earlier in the development lifecycle.

What This Means for PJM Projects

Organizations planning significant load additions in PJM should evaluate:

• Current interconnection queue positioning

• Likely study cycle duration

• Network upgrade exposure

• Regional transmission capacity constraints

• Options for phased energization or supplemental infrastructure

Proactive analysis reduces the risk of late-stage timeline adjustments.

PJM remains a critical market for data infrastructure, industrial expansion, and electrified growth. However, backlog and process complexity require disciplined planning.

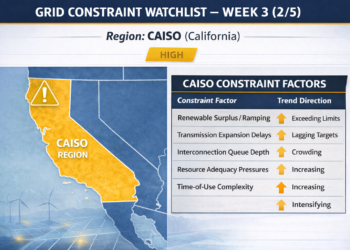

Next edition: CAISO — where policy ambition, renewable integration, and transmission expansion intersect.

Author Note

The Grid Constraint Watchlist examines where power delivery timelines are tightening across major U.S. markets as industrial and data-driven load expands.

If you are evaluating a PJM project or navigating the interconnection process directly, you are welcome to connect: