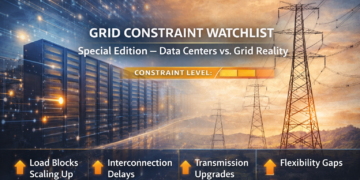

Across every major U.S. power market, one load category is rewriting grid planning assumptions: data centers.

AI expansion, hyperscale cloud growth, and digital infrastructure investment are accelerating faster than most transmission and interconnection processes were designed to handle.

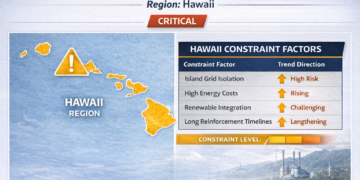

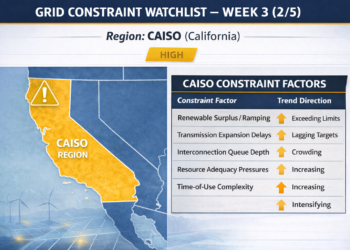

This is not a regional issue.

It is systemic.

The Scale Shift

Historically, large industrial facilities might request 20–80 megawatts of capacity. Today, new hyperscale campuses routinely request 200–500 megawatts, with phased expansion targets that can exceed one gigawatt.

That kind of demand changes everything:

• Substation design requirements

• Transmission reinforcement sequencing

• Resource adequacy modeling

• Interconnection study complexity

• Utility capital allocation timelines

Grid systems built for incremental growth are now facing concentrated load blocks at unprecedented scale.

Where the Friction Is Emerging

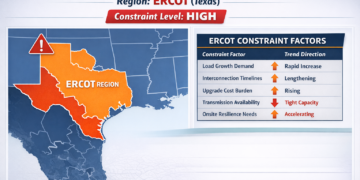

In ERCOT, it shows up as infrastructure velocity constraints.

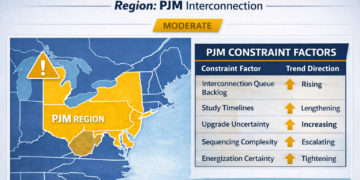

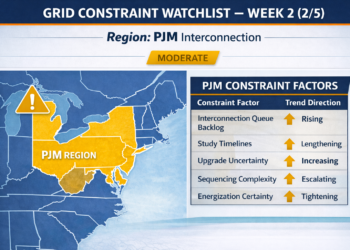

In PJM, it appears in interconnection backlog and upgrade sequencing.

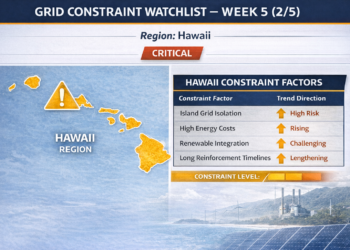

In CAISO, it manifests as transmission dependency and integration modeling.

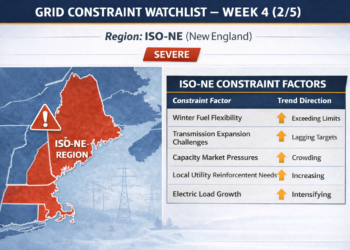

In ISO-NE, it intersects with structural reliability limitations.

The common thread is timing.

Energy availability may exist in aggregate.

Energy certainty at a specific site, at a specific scale, on a specific schedule, is becoming harder to guarantee.

A Market Signal Worth Watching

Several markets have now seen cases where data center projects secure land, incentives, and financing — only to discover that grid upgrades extend energization timelines materially.

The projects do not disappear.

They adapt.

But the capital implications are real.

The key shift is this:

Power is no longer assumed infrastructure.

It is a negotiated variable.

The Strategic Shift

Sophisticated developers are beginning to treat energy as a design layer, not a downstream utility request.

That means:

• Early interconnection modeling

• Phased energization strategies

• Hybrid grid + onsite architectures

• Storage integration for peak management

• Controlled load ramp strategies

In effect, the grid is becoming a co-developer.

What This Means for Infrastructure Planning

If large-load growth continues at its current trajectory, grid constraint conversations will move from regional issue to national industrial policy discussion.

Transmission buildout, permitting reform, interconnection process modernization, and distributed flexibility will shape the next decade of expansion.

The constraint is not a crisis.

It is a transition.

And transitions reward those who model risk early.

Author Note

The Grid Constraint Watchlist tracks power delivery dynamics as industrial and digital load expands across U.S. markets.

If you are evaluating large-load expansion or modeling interconnection timelines, you are welcome to connect: