California continues to lead the country in renewable deployment, battery storage buildout, and aggressive decarbonization policy.

At the same time, large-load growth is re-emerging — advanced manufacturing, electrified industrial processes, logistics infrastructure, and selective data center development.

However, in CAISO, the constraint story is not about lack of ambition.

It is about integration.

Where the Pressure Is Building

California’s grid is adding renewable capacity rapidly. Solar and storage are expanding at historic pace. Yet delivering firm, dispatchable power to specific sites remains complex.

Three forces are intersecting:

First, renewable penetration is high. That creates midday surplus and evening ramp stress. Developers must plan around time-of-day reliability dynamics.

Second, transmission expansion remains slow relative to policy targets. Many high-quality resource zones are geographically distant from major load centers. New transmission corridors take years to permit and build.

Third, interconnection queues remain crowded. Storage, solar, and hybrid projects compete for study bandwidth and system capacity.

As a result, the ability to secure firm, predictable power at scale requires early modeling.

A Market Signal Worth Watching

Recently, a project evaluating electrified operations within the CAISO footprint discovered that available capacity at its preferred node was heavily dependent on pending transmission upgrades.

Capacity existed in theory.

However, energization timing depended on infrastructure sequencing outside the project’s control.

That distinction is increasingly important in California.

Energy in CAISO Is a Structuring Exercise

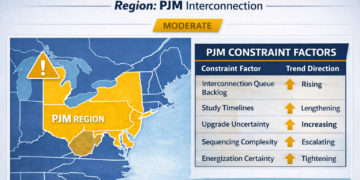

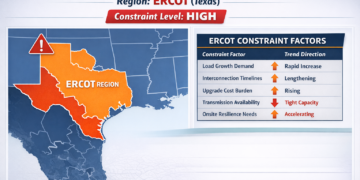

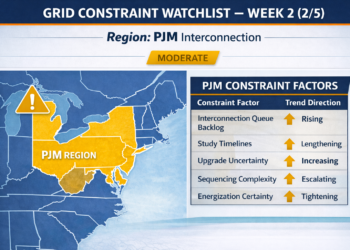

Unlike ERCOT, where speed drives constraint, or PJM, where backlog dominates, CAISO requires structural design.

Developers must account for:

• Time-of-use dynamics

• Resource adequacy requirements

• Curtailment risk

• Transmission congestion

• Policy-driven procurement shifts

The market offers opportunity. Yet certainty requires detailed planning.

In several cases, hybrid architectures — grid supply combined with storage or controlled load strategies — are becoming part of the feasibility discussion from the start.

What This Means for CAISO Projects

California remains a major economic engine. Advanced manufacturing and electrification will continue to grow. However, developers must approach energy strategy as a core design variable, not a downstream utility detail.

Early interconnection analysis and realistic modeling of transmission dependencies reduce late-stage surprises.

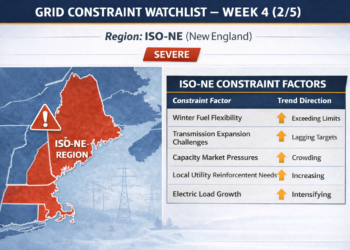

Next edition: ISO-NE — where limited regional capacity and winter reliability concerns shape the constraint narrative.

Author Note

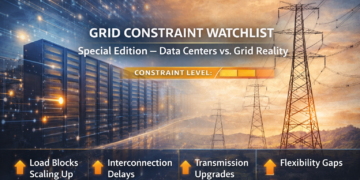

The Grid Constraint Watchlist tracks power delivery dynamics across major U.S. markets as industrial and data-driven load expands.

If you are evaluating a CAISO project or navigating interconnection realities in California, you are welcome to connect: