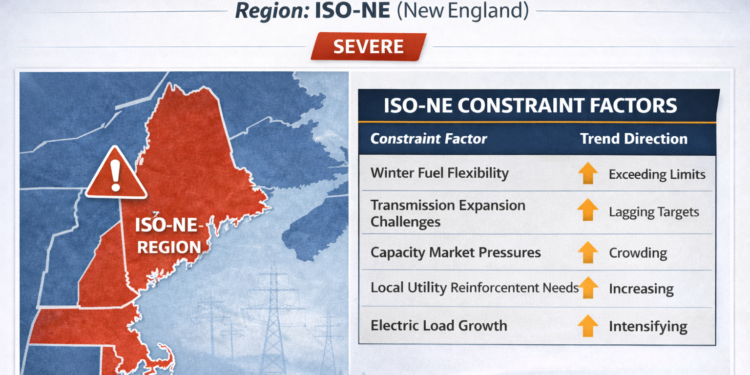

New England is not a high-growth power market in the way Texas or the Mid-Atlantic are. However, it is becoming one of the most structurally constrained regions in the United States.

ISO-NE operates in a geographically tight footprint with limited transmission expansion flexibility, aging infrastructure, and some of the most complex winter reliability dynamics in the country.

As electrification accelerates across heating, transportation, and industry, the region faces a fundamental challenge:

Demand is rising, but the system has limited room to absorb shocks.

Why ISO-NE Is Structurally Tight

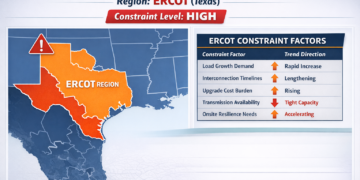

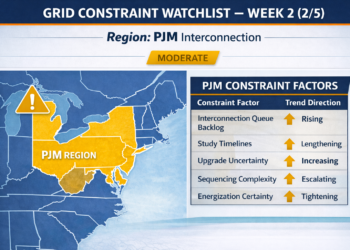

Unlike ERCOT or PJM, where constraint often emerges from queue depth or load velocity, ISO-NE’s constraint is structural.

First, the region has limited pipeline and fuel flexibility during peak winter conditions. Cold weather events can tighten natural gas availability, which directly impacts dispatchable generation reliability.

Second, transmission expansion is slow and difficult. Dense development patterns, permitting complexity, and community resistance make major upgrades a long-cycle process.

Third, capacity markets and resource adequacy planning play an outsized role. ISO-NE must maintain reliability in a region with limited interregional transfer capability.

Together, these factors create a grid environment where incremental load additions can have outsized planning implications.

A Market Signal Worth Watching

Recently, a commercial-scale electrification project in the ISO-NE footprint evaluated utility service upgrades and discovered that local capacity constraints and upstream reinforcement needs extended the timeline significantly beyond initial expectations.

The issue was not project demand.

It was the regional system’s limited flexibility.

That dynamic is increasingly relevant as electrification expands.

Reliability and Timing Are Linked in New England

In ISO-NE, energy delivery is not just about megawatts. It is about seasonal reliability, fuel assurance, and infrastructure constraints layered together.

For developers and operators, this means power planning must account for:

• Winter peak reliability exposure

• Local feeder and substation limitations

• Long-cycle transmission reinforcement

• Capacity market dynamics

• Electrification-driven demand growth

In this region, certainty often requires early engagement and detailed system-level analysis.

What This Means for ISO-NE Projects

New England remains an important market for advanced industry, life sciences, and institutional-scale development. However, the grid is less flexible than many assume.

Organizations planning load growth or electrified expansion in ISO-NE benefit from early evaluation of:

• Utility upgrade requirements

• Local capacity constraints

• Seasonal reliability considerations

• Options for onsite resilience and hybrid support

The constraint is not simply delay. It is structural tightness.

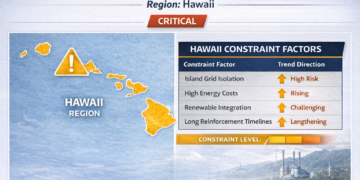

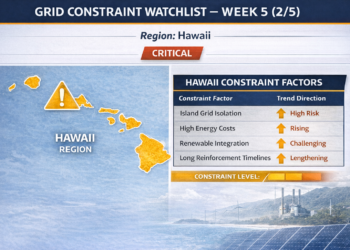

Next edition will focus on Hawaii — where isolation and fuel logistics create a completely different constraint environment.

Author Note

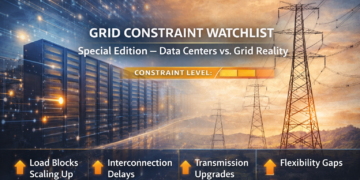

The Grid Constraint Watchlist tracks power delivery dynamics across major U.S. markets as industrial and electrified load expands.

If you are evaluating an ISO-NE project or navigating New England grid timelines directly, you are welcome to connect: